Estate Planning

Wills, Trusts & Powers of Attorney

Our estate planning attorneys are dedicated to helping you protect your assets and ensure your wishes are honored. Whether you need an estate attorney to draft a Will, set up a Trust, or navigate complex legal matters, our Sioux Falls trust attorneys have the expertise you need. Our Will lawyers provide personalized guidance to create a comprehensive estate plan tailored to your unique needs.

What is a Will?

A Will, technically known as a Last Will and Testament, is one the most fundamental components of any estate plan. It’s a legal document that controls the distribution of property after you pass away. Wills can help you accomplish all of the following goals:

- Name a guardian and/or conservator for your minor children

- Determine who receives your assets after you pass away, rather than the state making this decision for you based upon established guidelines for asset distribution

- Name the person or institution you want to manage your estate after you pass away

- Make gifts to charity

- Determine who will be responsible for paying estate and minimize other taxes you have to pay

What are the Requirements for a Will to be Valid?

In order for a Will to be valid, the testator, or the person creating the Will must be at least 18 years old and of sound mind; the Will must be in writing and signed by the testator and signed by two or more witnesses; or meet holographic requirements. Often people wonder if you can just write a Will and get it notarized. If you want to write your own Will, then you need to follow the holographic requirements. While there are formalities that need to be followed to make sure the Will is valid, it is critical that the Will sets forth the testator's intentions correctly. When you are creating a Will, there are a number of considerations to make sure loved ones are provided for correctly, reducing taxes, and reducing administrative costs. Creating a Will is important regardless of the size of your estate.

What Happens if I Die Without a Will?

If you die without a Will, your property will be distributed according to formulas determined by state statutes. That is, the state, not you, will control who gets what. These statutes are set in stone and make no exceptions for family members in need or what your loved ones claim you might or might not have wanted. The state also dictates who can be appointed to manage your estate, quite possibly a person you never would have wanted to handle this important matter. In addition, the cost of probating your estate without a will may very well be significantly higher than if you had created a valid will.

Contact Legacy Law Firm's Sioux Falls Will attorneys for a complimentary Will consultation.

What is a Trust?

A Trust is a legal entity that is used in estate planning to generally avoid probate, make it easier on loved ones, and certain types of trusts can be used to protect assets. Some of the trust law basics are knowing that a trust can help manage your property and assets to ensure a smooth transition or even protect assets. Our Sioux Falls Falls trust lawyers can walk you through the options in designing a trust that accomplishes your goals.

A trust can replace the primary purpose of a Will and provides the instructions for what needs to happen after a person dies and avoids probate at death. Often people wonder how much does a living trust cost? Generally, a living trust is going to cost more than establishing a Will because you are doing a lot of the work upfront so that those you leave behind have less work and the costs of probate or tax or other problems. Visit with one of our Sioux Falls trust attorneys to help guide you through the options, benefits costs and what you will be saving by doing a trust plan.

There are several different types of trusts, capable of helping you accomplish a wide range of planning goals. Together they represent some of the most powerful tools in the estate planner’s toolbox.

What is a Revocable Living Trust?

A revocable living trust is one of the most commonly used trusts. Revocable living trusts allow you to transfer your assets as you choose – not all at once. One of the primary benefits of a Revocable Living Trust, besides allowing your estate to avoid probate, is that it lets you make adjustments to your trust as your personal and financial situation changes.

How does a revocable living trust work? A revocable living trust is created while you are alive. Most often, certain assets are then re-titled to be owned by the trust itself. As long as the assets are owned by the trust or otherwise has beneficiary designations, you can avoid probate.

What are the benefits of a Revocable Living Trust?

- Avoid probate. This is important because probate is typically time-consuming, frustrating and needlessly expensive. Probate also exposes your financial situation and family matters to public scrutiny

- Adjust for changes in your family and financial situation

- Eliminate challenges to your Will and better ensure your beneficiaries receive what you have intended for them

- Allow for separation of assets, which may be useful for tax purposes and protecting assets

- Provides for ongoing financial management in the event you become incapacitated and upon passing

What is an Irrevocable Trust & What are the Benefits of an Irrevocable Trust?

An irrevocable trust is often used for protection. Some irrevocable trusts, such as a spousal lifetime access trust, a domestic asset protection trust, a dynasty trust, or a life insurance trust are often used to protect from taxes. A supplemental needs trust or a special needs trust is used to protect from the government so that the beneficiary may continue to be eligible to receive government benefits without having to spend the trust assets down. A Medicaid asset protection trust is used to protect from the nursing home. An inheritance protection trust can be used if you are worried a child might go through a divorce to protect the inheritance you want to leave them or just want to make sure assets are protected for children and able to then pass down to grandchildren. These are only some of the many tools and techniques an estate planner has to accomplish protection goals. However, if you want an irrevocable trust, it is critical that you do it right. You don’t want a lockbox that you can’t access or make changes to, or worse yet, doesn’t even meet your goals when the rubber meets the road because something wasn’t done correctly. When done correctly, irrevocable trusts can protect what matters most, help you with taxes, and keep your life easy.

What is a Power of Attorney and Why Do I Need One?

A power of attorney is a lifeline to make sure you are legally taken care of if you become incapacitated. Anyone over the age of 18 should have powers of attorney. A medical power of attorney or healthcare power of attorney authorizes someone you name and whom you trust to make healthcare decisions for you if you cannot. You should choose the specific options you want for your healthcare and treatment if you need life sustaining measures taken, organ donation, and many more options. The more directions you can provide, then you know your wishes will be followed and it makes it easier on your loved ones who are otherwise forced to guess (and sometimes disagree) on what you want to have happen. A durable financial power of attorney is a document that you authorize a trusted individual to step into your shoes and handle your financial affairs and your property. Generally, you should have both a financial power of attorney and a medical power of attorney.

Why Choose Our Estate Planning Attorneys?

Choosing the right estate planning attorney is crucial. Our experienced team offers comprehensive services, including trust creation, will drafting, and estate administration. As leading estate attorneys in South Dakota, we are committed to providing the highest level of service to protect your legacy.

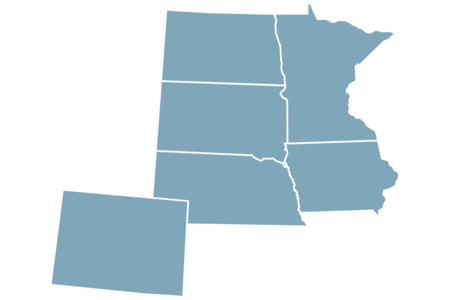

Our estate planning lawyers will make sure you and your loved ones have the right estate plan and estate planning documents in place. But protecting your family requires more than just documents. What if there was an estate planning law firm that would be there for your family when you can't be? Here at Legacy Law Firm, this is our purpose and mission. We want our legacy to be a legacy of helping others, especially at a time when they need it most. Schedule a free initial meeting to visit with one of our Sioux Falls estate planning attorneys to learn more about your estate planning options and how we can help. Our estate planning attorneys have worked hard to help families throughout the states of South Dakota, Iowa, Minnesota, Nebraska, North Dakota and Colorado. Even if you are looking for an estate planning attorney near me, we are happy to offer virtual meetings and phone calls for those who are a driving distance way (or even if you are just down the street)!

Locations We Serve

Legacy Law Firm offers legal services in estate planning, asset protection, elder law and trusts to individuals and businesses throughout the Midwest. We currently practice in these states:

- South Dakota

- Iowa

- Minnesota

- Nebraska

- North Dakota

- Colorado

Be Educated

Embarking on the journey of creating a will is a crucial step in securing your legacy and ensuring your wishes are honored. In our blog, our expert will attorneys unravel the intricacies of will preparation, offering insights, tips, and essential information to empower you in crafting a comprehensive and legally sound testament.